The pace of the continuing banking industry consolidation remains impacted by the COVID pandemic. The Banking Industry Consolidation Rate was 2.3% for the trailing 4 quarters compared to the long term annual rate of 3.7%.

The Bank Merger Rate was only 2.3% L4Q compared to the 4.4% rate over the past 3+ decades.

The Bank Failure Rate over the L4Q was nearly 0.0%, showing the financial strength of the industry today.

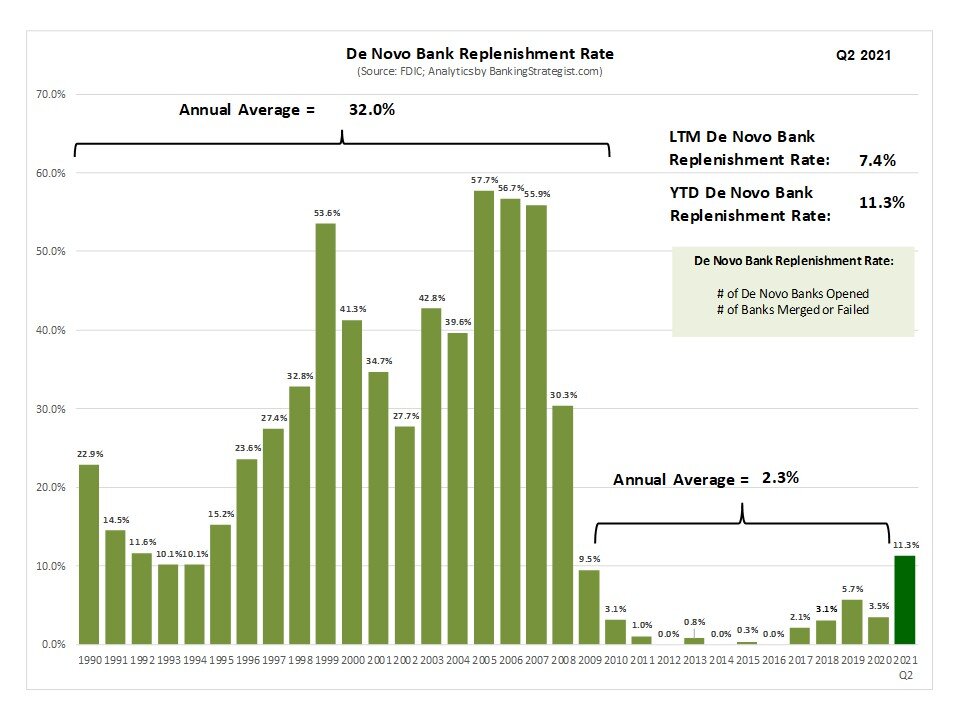

And, while the De Novo Bank Replenishment Rate rose to 7.4% - primarily due to the drop in bank merger activity rather than a resurgence of de novo banking, this rate remained well below the average rate of 21.8% over the past several decades.

YTD Q2 2021 there was a net loss of 51 banking charters. On an annualized basis of 102, this decline is even lower than the drop of 175 bank charters in 2020 - the Year of COVID.

The banking industry consolidation rate was only 2.0% on an annualized rate for the first half of 2021. These low rates of consolidation were last seen during the years leading up to the Great Recession as banks found organic growth preferred over acquisition growth - they were fooled!

The Bank Merger Rate for the first half of 2021 was only 2.1% - at near historic lows going back to the 1980’s! As seen during 2020, Community Banks continue to be leading the bank merger activity (or what exists), accounting for over 80 percent of transactions.

There has been some de novo bank activity. The De Novo Bank Replenishment Rate was 7.4% L4Q. But this level was achieved primarily because bank merger activity had declined significantly.

One of the positive signs for the banking industry has been the lack of bank failures. The Bank Failure Rate was near 0.0% L4Q. Solid earnings. Excellent credit quality. Strong capital levels. And - most importantly, no fraudulent activity!

The consolidation of the banking industry will continue. It may take another quarter or two before it starts to move toward its historic average rate. Bank mergers will pick up. Bank failures will continue to be the one off. De novo bank will also be more of the one or two offs as it has seen its role decline as the regulatory burden remains high. Consolidation has been ongoing for decades - and it may continue for decades.

So let’s watch the Q3 results later this year.